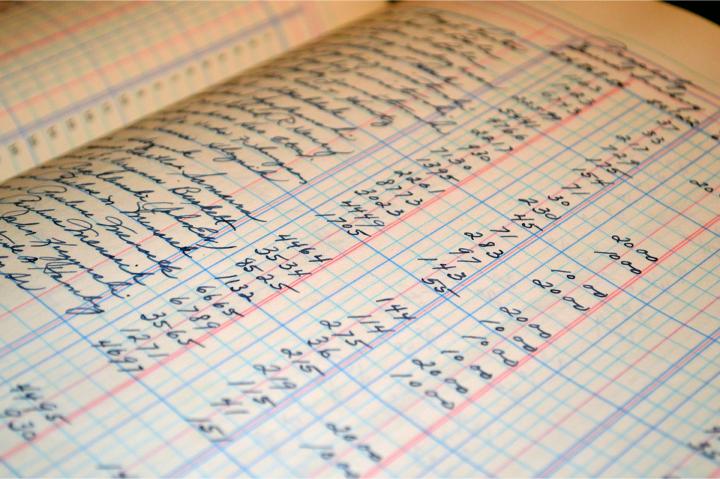

In the world of finance, accuracy is non-negotiable. A single bookkeeping error can have a ripple effect, impacting financial decisions and jeopardizing the stability of your business. In this blog post, we’ll explore the importance of preventing and detecting bookkeeping errors and unveil strategies to keep your financial records accurate and reliable.

The High Cost of Bookkeeping Errors:

Financial Fallout – Bookkeeping errors can lead to financial mismanagement, resulting in inaccurate budgeting, poor decision-making, and even legal complications. Understanding the potential consequences underscores the importance of vigilance in your bookkeeping processes.

Strategies for Preventing Bookkeeping Errors:

Implement a Double-Entry System:

Adopting a double-entry system provides an additional layer of accuracy by recording each transaction in two separate accounts. This system reduces the likelihood of errors and ensures that your books stay balanced.

Regular Reconciliation:

Reconcile your accounts regularly, comparing your financial records against bank statements and other relevant documents. This proactive approach helps identify discrepancies before they escalate into significant issues.

Standardize Chart of Accounts:

Establishing a standardized chart of accounts simplifies the categorization of transactions. Consistency in coding ensures uniformity across your financial records, minimizing the risk of misclassification errors.

Technology as an Ally:

Utilize Accounting Software:

Investing in robust accounting software can streamline your bookkeeping process and significantly reduce the risk of manual errors. These tools automate calculations, flag inconsistencies, and provide real-time insights into your financial health.

Leverage Cloud-Based Platforms:

Cloud-based accounting platforms offer the advantage of accessibility and collaboration. With real-time updates, multiple users can work simultaneously, reducing the chances of communication gaps and errors.

Common Bookkeeping Errors to Watch For:

Data Entry Mistakes:

Simple typos or numeric errors during data entry can lead to significant discrepancies. Implement a system for double-checking entries to catch these mistakes early.

Misclassifications:

Incorrectly categorizing transactions can distort your financial reports. Regularly review your chart of accounts and ensure that transactions are consistently assigned to the appropriate categories.

Failure to Reconcile:

Neglecting regular reconciliation with bank statements and other financial documents can result in undetected errors. Make reconciliation a routine part of your bookkeeping process.

Establishing Internal Controls:

Segregation of Duties:

Divide bookkeeping responsibilities among multiple individuals to create a system of checks and balances. This reduces the risk of fraudulent activities and ensures that errors are more likely to be caught.

Audit Trail:

Maintain a comprehensive audit trail for all financial transactions. This detailed record allows for easy tracing of errors, providing insights into when and how they occurred.

The Importance of Professional Oversight:

Regular Audits:

Periodic external audits by accounting professionals can offer an unbiased assessment of your financial records. Their expertise can uncover errors that might go unnoticed during routine checks.

Ongoing Training:

Invest in ongoing training for your bookkeeping staff to keep them informed about the latest accounting standards and best practices. Knowledgeable staff are better equipped to prevent and detect errors.

Preventing and detecting bookkeeping errors is a continuous and collaborative effort. By implementing these strategies and embracing technological advancements, you can fortify your financial foundation, ensuring accuracy, transparency, and informed decision-making for the long-term success of your business.